Data Centers in Virginia

WHY WE DID THIS STUDY

In 2023, the Joint Legislative Audit and Review Commission directed staff to review the impacts of the data center industry in Virginia.

ABOUT DATA CENTERS

Data centers are specialized facilities that manage, process, and share large amounts of data. They enable the digital services that people rely on daily, including websites, electronic applications, and cloud-based platforms, such as email and media steaming. Northern Virginia is the largest data center market in the world, constituting 13 percent of all reported data center operational capacity globally and 25 percent of capacity in the Americas. Multiple factors have contributed to Northern Virginia’s market prominence, including a strong fiber network, supply of reliable cheap energy, available land, proximity to major national customers, and the creation of a state data center tax incentive. The data center industry is growing rapidly in Virginia, both in established markets and newer ones. Significant new market growth is expected in counties outside of Northern Virginia and along the I-95 corridor to Central Virginia.

WHAT WE FOUND

Data centers provide positive economic benefits to Virginia’s economy, mostly during their initial construction

Data centers provide positive benefits to Virginia’s economy mostly because of the industry’s substantial capital investment. The primary benefit comes from the initial construction of data centers. Most construction spending likely remains in the state economy because much of it goes to Virginia-based businesses providing construction materials and services.

Data centers employ fewer employees than some other industries, but data center jobs tend to be high paying. Several data center representatives indicated that a typical 250,000-square-foot data center may have approximately 50 full-time workers, about half of which are contract workers. Data center construction supports a substantially larger number of workers. Construction of an individual data center building usually takes about 12 to 18 months, and data center representatives indicated that, at the height of construction, approximately 1,500 workers are on site from various construction-related industries.

Overall, the data center industry is estimated to contribute 74,000 jobs, $5.5 billion in labor income, and $9.1 billion in GDP to Virginia’s economy annually. Most of these economic benefits derive from the construction phase rather than data centers’ ongoing operations. The economic benefits from the industry are concentrated in Northern Virginia, where most data centers are located, but other regions of the state also benefit because data centers are also located there, or they are home to businesses that provide materials for data center construction.

Data centers can generate substantial local tax revenues for localities that have them

Localities with data centers can collect substantial tax revenues from the industry, primarily from business personal property and real property (real estate) taxes. The amount of local data center revenue depends on several factors, such as the size of their data center market and local tax rates. Some localities have greatly reduced their business personal property tax rates for computer equipment to try to attract data centers, but this also reduces the revenue they can collect from the industry. For the five localities with relatively mature data center markets, data center revenue ranged from less than 1 percent to 31 percent of total local revenue.

Localities in economically distressed areas of the state could benefit from data centers through increased local tax revenue, but these localities could have difficulty attracting the industry. Access to power and large, flat areas of land are key requirements for data centers, but are not available in some distressed areas, particularly in Southwest Virginia. Many distressed localities are also in rural areas that are away from data center customers and population centers, which makes it harder for them to attract the industry. However, these localities may be able to compete for data centers running certain artificial intelligence (AI) workloads, such as training. These localities could potentially become more attractive to the industry if they are able to proactively develop industrial sites suitable to data centers.

Data center industry is forecast to drive immense increase in energy demand

Modern data centers consume substantially more energy than other types of commercial or industrial operations. Consequently, the data center industry boom in Virginia has substantially driven up energy demand in the state, and demand is forecast to continue growing for the foreseeable future. The state’s energy demand was essentially flat from 2006 to 2020 because, even though population increased, it was offset by energy efficiency improvements. However, an independent forecast commissioned by JLARC shows that unconstrained demand for power in Virginia would double within the next 10 years, with the data center industry being the main driver. JLARC’s independent forecast largely matches the most recent forecast by PJM, which is the regional organization that coordinates generation and transmission operations for Virginia and several other eastern and midwestern states.

Data center demand would drive immense increase in energy needs in Virginia, based on JLARC’s independent forecast and other forecasts

Building enough infrastructure for unconstrained data center demand will be very difficult and meeting half that demand is still difficult

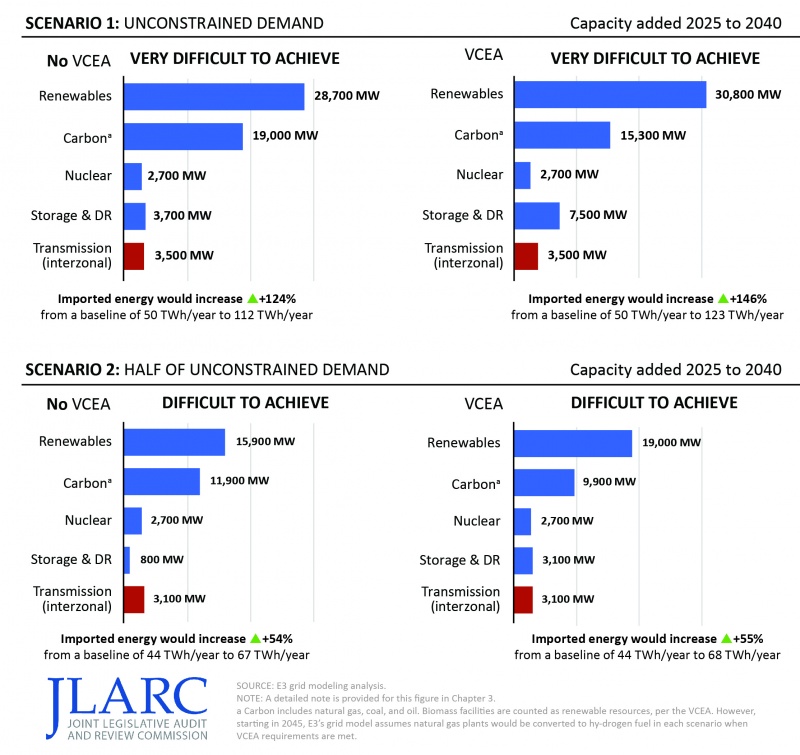

An independent model of the energy grid commissioned by JLARC staff found that a substantial amount of new power generation and transmission infrastructure will be needed in Virginia to meet unconstrained energy demand or even half of unconstrained demand. Building enough infrastructure to meet unconstrained energy demand will be very difficult to achieve, with or without meeting the Virginia Clean Economy Act (VCEA) requirements (Scenario 1, figure). New solar facilities, wind generation, natural gas plants, and increased transmission capacity would all be required to meet unconstrained demand, and the number of projects needed would be very difficult to achieve. For example, new solar facilities would have to be added at twice the annual rate they were added in 2024, and the amount of new wind generation needed would exceed the potential capabilities of all offshore wind sites that have so far been secured for future development. Large natural gas plants would also need to be added at an equal or faster rate than the busiest build period for these facilities (2012 to 2018), depending on VCEA compliance.

Estimated generation mix needed to meet demand scenarios, with and without meeting VCEA requirements

Building enough infrastructure to meet half of unconstrained energy demand would also be difficult (Scenario 2 above). If VCEA requirements were not considered, the biggest challenge would be building new natural gas plants. New gas would need to be added at the rate of about one large 1,500 MW plant every two years for 15 consecutive years, equal to the busiest period of the last decade (2012 to 2018). If it is assumed that VCEA requirements would be met, the biggest challenges would be building enough wind, battery storage, and natural gas peaker plants. Wind generation needs would be the same as the unconstrained demand scenario. The amount of new battery storage would be several times the small amount currently in place in Virginia and a significant number of new natural gas peaker plants would have to be constructed. Both Scenarios 1 and 2 would rely on energy from as yet unproven nuclear technologies.

The state could encourage or require data centers to take actions to help address their energy impacts by promoting development of renewable energy generation, participating in demand response programs, and managing energy efficiency. However, these actions would have only a marginal impact on decreasing data center energy demand.

Existing electric utility requirements and processes help limit risks associated with system capacity and reliability

Data centers’ projected energy demand increases have raised concerns about whether enough infrastructure can be built to keep pace. Currently, PJM attempts to protect regional grid reliability by requiring utilities to secure sufficient generation capacity plus a reserve margin, and the state requires utilities to develop plans that describe how generation capacity needs will be met. However, individual electric utility planning does not guarantee that the generation resources needed for the whole PJM region will be built because regional generation is not centrally planned. This is less of a concern with transmission because PJM and utility transmission owners centrally identify the impact large loads are expected to have, and how those loads can be brought on safely without causing transmission reliability problems.

If utilities are unable to build enough new infrastructure to keep pace with demand, one of the main ways they can protect grid reliability is by delaying the addition of new large load customers until there is adequate generation and transmission capacity. Utilities appear to be able to delay large load additions for transmission-related concerns, but it is less clear if they are allowed to delay adding new load because of generation concerns.

Data centers are currently paying their full cost of service, but growing energy demand is likely to increase other customers’ costs

JLARC staff commissioned an independent study of electric utility cost recoveries under current rate structures to see if the data center industry is paying its share of current costs. The study found that current rates appropriately allocate costs to the customers responsible for incurring them, including data center customers.

However, data centers’ increased energy demand will likely increase system costs for all customers, including non-data center customers, for several reasons. A large amount of new generation and transmission will need to be built that would not otherwise be built, creating fixed costs that utilities will need to recover. It will be difficult to supply enough energy to keep pace with growing data center demand, so energy prices are likely to increase for all customers. Finally, if utilities are more reliant on importing power, they may not always be able to secure lower-cost power and will be more susceptible to spikes in energy market prices. A typical residential customer of Dominion Energy could experience generation- and transmission-related costs increasing by an estimated $14 to $37 monthly in constant (or real) dollars by 2040 (independent of inflation). Establishing a separate data center customer class, changing cost allocations, and adjusting utility rates more frequently could help insulate non-data center customers from statewide cost increases.

Data centers create additional financial risks to electric utilities and their customers

The data center industry presents additional financial risks to electric utilities and their customers because of the sheer size of the industry’s energy demand. One risk is that utilities will build more generation and transmission infrastructure than is needed if forecast demand does not materialize, or several large data centers close. This could strand utilities with infrastructure costs that would have to be recouped from their existing customer base. Another risk is particular to electric co-ops, which are not-for-profit companies that are owned by their member customers. If a data center customer delayed, disputed, or failed to pay an energy generation bill and the co-op was unable to recoup these costs from the customer, they would ultimately have to be paid by all other co-op members. A large enough bill could potentially result in a co-op defaulting and going bankrupt.

Another risk relates to data center participation in the state’s retail choice program, which allows data centers and other large load customers to purchase generation through third parties rather than through their incumbent electric utility. This also has the potential to shift generation costs to other customers if enough data centers “leave” their incumbent utility for retail choice.

Data center backup generators emit pollutants, but their use is minimal, and existing regulations largely curb adverse impacts

To ensure constant operations in the event of a power outage, nearly all data centers maintain diesel generators on-site for backup power. Diesel generators emit several harmful air pollutants, such as nitrogen oxides, carbon monoxide, and particulate matter. To limit potential emissions from backup generators, the Virginia Department of Environmental Quality (DEQ) permits limit when they can be run, how long they can be run, and the maximum annual emissions each permitted site is allowed. Nearly all current data centers use “Tier 2” diesel generators, which DEQ allows to run only in emergencies or as part of routine maintenance testing.

Data center generators are run mostly only for maintenance, and most data center operators interviewed by JLARC staff reported experiencing zero to two minor outages per site in the last two years, with nearly all outages being only a few hours long. Consequently, data centers’ diesel generators are a relatively small contributor to regional air pollution—in Northern Virginia, they make up less than 4 percent of regional emissions of nitrogen oxides and 0.1 percent or less of carbon monoxide and particulate matter emissions. While they make up only a small part of regional emissions, DEQ is conducting further study to ensure no harmful impacts occur locally. If the study detects any local air quality impacts, DEQ has the authority to increase protections as needed.

Data center water use is currently sustainable, but use is growing and could be better managed

Data centers require industrial-scale cooling, which is sometimes dependent on water, to manage the heat generated by their computing equipment. Most data centers use about the same amount of water or less as an average large office building, although a few require substantially more, and some require less than a typical household. The amount of water a data center uses depends on its size, computing density, and type of cooling system.

Most data centers receive their water from local water utilities, which make withdrawals from Virginia’s water sources (rivers, groundwater). DEQ regulates water withdrawals, including requiring permits for large-scale withdrawals, to protect future water availability and environmental sustainability. However, while DEQ is responsible for ensuring water sustainability, there is less oversight over how available water should be shared across various uses in a locality. Virginia as a whole is relatively water rich, but water is more limited for some localities that do not have access to large amounts of surface water and are in groundwater management areas.

Localities have allowed data centers to be built near neighborhoods, but some localities are taking steps to minimize residential impacts

The industrial scale of data centers makes them largely incompatible with residential uses. One-third of data centers are currently located near residential areas, and industry trends make future residential impacts more likely.

Inadequate local planning and zoning have allowed some data centers to be located near residential areas, which sometimes causes impacts on those residents. In some cases, this occurred because local zoning ordinances did not consider data centers to be an industrial use. In addition, some localities have zoned industrial areas next to residential areas, even though land use principles state that industrial uses and residential uses should not be zoned next to each other. Local elected officials have also granted data centers exceptions that led to adverse residential impacts, such as approving rezonings that would allow data centers next to sensitive locations.

In response to increased residential opposition, some localities have taken steps to minimize the residential impacts of data centers. The three Virginia localities with the largest data center markets have taken or are considering changes to zoning ordinances to better manage future data center development, and several localities considering their first data center projects are proactively implementing planning and zoning changes to promote appropriate industry development. The effectiveness of local efforts to minimize residential impacts ultimately depends on the decisions of local elected officials when considering more restrictive zoning ordinances or individual special permit or rezoning requests.

Data center noise near residential areas presents unique challenges, and some localities are unsure about their authority to address it

The constant nature of data center noise has sometimes been a problem when data centers are located near residential areas. Data centers emit low-frequency noise that is not loud enough to damage nearby residents’ hearing and rarely loud enough to violate noise ordinances. However, some nearby residents report that the constant noise generated by some data centers affects their well-being. Although noise has been a problem for some data centers, a large majority of data centers do not generate noise complaints because of their location or design.

Localities traditionally use noise ordinances to address noise concerns, but those typically target excessively loud noise from short-term sources, such as parties and barking dogs, and carry a low maximum civil penalty of $500. Noise restrictions for data centers could be more effective if included in zoning ordinances instead, but some localities were uncertain whether they have the authority to establish these restrictions in such ordinances. Zoning ordinances that establish maximum allowable sound levels for both new and existing data centers would allow localities to better account for the low-frequency noise data centers emit, prescribe a better process for measuring potential noise violations, and impose more effective penalties for addressing any violations.

Some data center companies are conducting sound modeling studies before building data centers, but not all Virginia localities currently require this, and some were unsure whether they had the authority to do so.

Changes to the state’s data center sales tax exemption could address some policy concerns related to the industry

Since 2010, Virginia has offered an exemption to the state’s retail sales and use tax to attract large-scale data centers. The exemption allows data centers and their tenants to purchase computers and other equipment, such as servers, network infrastructure, cooling equipment, and generators, without paying sales tax. Because data centers are capital intensive, the exemption is valuable to the industry (providing $928 million in tax savings in FY23), and about 90 percent of the industry uses the exemption. Data center companies report the exemption is an important factor when deciding where to locate and expand, and most of the other states that Virginia competes with for new data center developments have similar exemptions.

Because the data center exemption is a valuable incentive and used by most of the industry, it could be used to incentivize data centers to take actions to address many of the issues discussed throughout this report. There are a range of changes that could be made to the exemption, depending on the General Assembly’s policy objectives.

Extend the exemption to maintain industry growth ― If the General Assembly wishes to maintain data center industry growth in Virginia and the associated economic and local tax revenue benefits, it could extend the exemption. The exemption is scheduled to expire in 2035, and data center representatives unanimously reported that expiration of the exemption would negatively affect the state’s ability to attract new data centers and keep existing ones. Data center companies typically consider the cost of ownership over a 15- to 20-year period when making location decisions, so to influence future site selection decisions, an extension would need to be in place well before 2035.

Allow the exemption to expire to reduce industry growth and associated energy impacts ― If the General Assembly wishes to slow the data center industry’s growth in Virginia because it determines that energy impacts, including increasing costs to residential and other customers, outweigh the industry’s economic benefits, it could allow the exemption to expire in 2035. While the General Assembly could allow the exemption to expire only in certain regions, like Northern Virginia, that approach would be less effective in reducing overall growth in energy demand because significant growth is occurring in several counties outside of Northern Virginia and is expected to continue.

Change the exemption to balance industry growth and energy impacts ― Rather than choosing between economic benefits or reduced energy impacts, the exemption could be changed to try to balance these competing impacts. The General Assembly could allow the full exemption to expire in 2035 (or end it before then) and apply a partial sales tax exemption until 2050. A partial exemption would also better align the economic benefits the state receives with the value of the exemption. Most economic benefits occur during construction, and switching to a partial exemption in 2035 would reduce the value of the exemption in later years when the economic impacts of current and planned data centers could be expected to slow. A partial exemption could also generate more tax revenue for the state.

Use the exemption to address other policy concerns related to the data center industry ― If the General Assembly extends the exemption, even as a partial exemption, there are several additional options the General Assembly could implement to address concerns in specific policy areas. The exemption could be modified to address energy, natural resource, historic resource, and residential impacts.

WHAT WE RECOMMEND

This report includes multiple policy options for the General Assembly to consider depending on its policy goals for the data center industry in Virginia. The report also includes several recommendations. The following recommendations include only those highlighted in the report summary. The complete list of recommendations and options is available here.

Legislative action

- Clarify that electric utilities have the authority to delay, but not deny, service to customers when the addition of customer load cannot be supported;

- Direct Dominion Energy to develop a plan for addressing the risk of infrastructure costs being stranded with existing customers, and file that plan with the State Corporation Commission;

- Expressly authorize local governments to require and consider water use estimates for proposed data center developments;

- Expressly authorize local governments to require sound modeling studies for proposed data center developments; and

- Expressly authorize local governments to establish and enforce maximum allowable sound levels for operational data center facilities using alternative low frequency metrics and zoning ordinances.

Executive action

- The Virginia Economic Development Partnership should clarify that grants under the Virginia Business Ready Sites Program can be used for potential data center sites.

The complete list of recommendations is available here.