The Costs of Virginia's Dual Enrollment Program

WHY WE DID THIS STUDY

In 2022, JLARC approved a study resolution directing JLARC staff to review the costs incurred by community colleges and school divisions to operate dual enrollment programs in Virginia. The study focused on non-career and technical education dual enrollment courses taught on public high school campuses in partnership with Virginia’s 23 community colleges. Dual enrollment courses taught on college campuses or in partnership with other higher education institutions were not part of this review.

ABOUT VIRGINIA'S DUAL ENROLLMENT PROGRAM

Through dual enrollment programs, high school students earn college credits by taking college-level courses, primarily at their high school or a community college. State law requires school divisions to offer dual enrollment. Most dual enrollment courses are taught at high schools by high school teachers. Dual enroll participation increased 54 percent between the 2012–13 academic year and 2021–22. Dual enrollment students as a proportion of total community college enrollment has grown from 13 percent in 2012 to 28 percent in 2021.

WHAT WE FOUND

Recent changes expected to improve the quality and transferability of dual enrollment courses, but there is a shortage of qualified high school teachers for dual enrollment

in 2018, the General Assembly passed legislation to improve the quality of the state’s dual enrollment programs and to increase the likelihood that the state’s public four-year higher education institutions would accept dual enrollment credits. The reforms required by the legislature—and implemented by the Virginia Community College System (VCCS), the State Council of Higher Education for Virginia (SCHEV), and Virginia’s public higher education institutions—are likely to accomplish these goals, helping students achieve the time and cost savings that are promoted as a key benefit of dual enrollment courses.

A primary obstacle to increasing the number of Virginia high school students who can benefit from these reforms is the shortage of high school teachers qualified to teach dual enrollment courses. To teach dual enrollment, high school teachers must meet the same qualification requirements as community college faculty, which must conform to the requirements of the colleges’ accrediting body. Dual enrollment teachers are required to earn 18 credits at the master’s degree level in the subject area they teach, which is costly and time-consuming to complete. Additionally, teaching dual enrollment courses requires extra work for teachers, but few school divisions provide supplemental compensation for it.

School divisions incur more expenses than community colleges to operate dual enrollment programs

Community colleges and school divisions collaborate to offer dual enrollment programs, and both incur dual enrollment-specific expenses. Community colleges dedicate staff time to accredit school divisions’ teachers, approve the course materials, and supervise course instruction, while school divisions provide the dual enrollment courses at the high schools and offer academic advising to students about dual enrollment programs. Both community colleges and school divisions incur other dual enrollment-specific costs as well, such as IT costs.

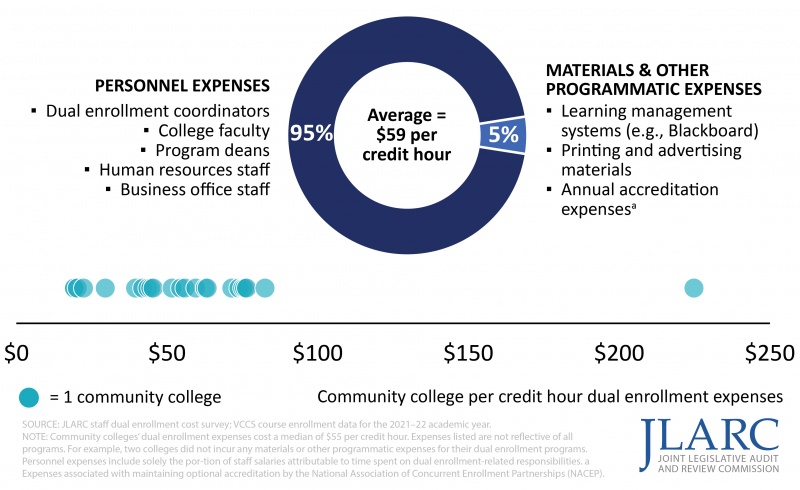

Community colleges’ dual enrollment expenses are $59 per credit hour, on average. The salaries of the faculty and staff who administer and supervise the program make up most of colleges’ costs. School divisions’ dual enrollment expenses are $276 per credit hour, on average. The largest component of these expenses is teacher compensation.

Community colleges spend an average of $59 per credit hour on dual enrollment, driven mostly by personnel costs

Most community colleges charge tuition and fees to cover dual enrollment costs, averaging about $24 per credit hour

VCCS considers dual enrollment students to be college students, and colleges charge the school divisions in their service areas for each student who enrolls in a dual-enrollment course taught at the high school. VCCS policy requires community colleges to charge school divisions no more than 40 percent of the tuition charged to traditional college students and allows school divisions to negotiate even lower tuition with the community college in their region, which all do. Most colleges also charge fees in addition to tuition. In 2021–22, 21 of Virginia’s community colleges charged school divisions an average of about $24 per credit hour in dual enrollment tuition and/or fees, which amounted to about $200 for a student taking a typical course load of three, three-credit hour courses.

School divisions spend an average of $276 per credit hour on dual enrollment operating expenses, driven mostly by personnel costs

An estimated majority of dual enrollment students in Virginia pay no tuition and fees for dual enrollment courses

Of the school divisions for which information was available, 63 percent of students do not pay dual enrollment tuition and fees. Based on the information available for these divisions, an estimated majority of students statewide do not pay dual enrollment tuition and fees. School divisions that are subject to charges from community colleges absorb these charges rather than pass them on to students. Students who are charged by their school divisions for dual enrollment pay about $33 per credit hour on average, or about $300 per year for an average course load of three, three-credit courses.

All community colleges, and the vast majority of school divisions, receive enough general funds to cover their dual enrollment costs

VCCS bases community colleges’ state general fund allocations on their full-time equivalent students enrolled each fall—and counts dual enrollment and non-dual enrollment students equally. In the 2021–22 academic year, each community college received substantially more general funds than needed to cover its dual enrollment programs’ costs. Community colleges report they use this funding to support other aspects of their operations. For example, several colleges reported using these funds to support their career and technical education programs, which can be especially costly to operate because of the technology, space, and faculty expertise required.

Of the school divisions that responded to a JLARC survey, 94 percent reported receiving sufficient state and local funding to cover their dual enrollment expenses. Based on these survey results, it is estimated that the vast majority of school divisions receive enough state and local funds to cover their dual enrollment costs.

Charging dual enrollment students tuition and fees is unnecessary and creates a barrier for economically disadvantaged students

Charging students for dual enrollment is not necessary because all colleges and the vast majority of school divisions receive sufficient state and local funding to cover dual enrollment program costs. This unnecessary tuition imposes costs on a substantial number of students and leads to inconsistencies in the amount students pay for dual enrollment across the state. Charging dual enrollment tuition and fees also makes dual enrollment less accessible to economically disadvantaged students.

WHAT WE RECOMMEND

Legislative action

- Include language in the Appropriation Act prohibiting community colleges and school divisions from charging tuition and fees for non-career and technical education dual enrollment courses taught on public high school campuses as long as state funds cover dual enrollment expenses.

- Direct community colleges to document and track the amounts and sources of revenues and expenses related to their dual enrollment programs to improve transparency in what colleges spend to operate their dual enrollment programs, how they are funded, and funding sufficiency.

- Include language in the Appropriation Act to specify the amount appropriated for non-career and technical education dual enrollment courses taught on public high school campuses, based on community colleges’ dual enrollment costs, to ensure transparency in state funding decisions.

- Direct VCCS to design and implement a process for distributing state funds to community colleges for their dual enrollment students based on the dual enrollment program expenses reported by the colleges to ensure transparency in how each college’s dual enrollment program is funded.

- Assign to SCHEV responsibility for overseeing the state’s dual enrollment program.

POLICY OPTIONS FOR CONSIDERATION

- Appropriate funding for bonuses to high school dual enrollment teachers.

- Appropriate funding to pay college faculty to teach dual enrollment courses at high schools with an insufficient number of dual enrollment teachers.

- If the General Assembly prohibits colleges and school divisions from charging dual enrollment tuition and fees: (i) appropriate funding for community colleges to replace dual enrollment tuition and fee revenue and (ii) create a grant program for school divisions that demonstrate the need for funds to create or maintain high-quality, well-staffed dual enrollment programs.

- Make no changes to the methodology that is used to base appropriations to VCCS for colleges’ Educational and General Programs so that community colleges’ overall funding levels are not reduced by the surplus amount of state funds they have been receiving for dual enrollment programs.

The complete list of recommendations is available here.