Transportation Infrastructure and Funding

WHY WE DID THIS STUDY

In 2020, the Joint Legislative Audit and Review Commission (JLARC) directed its staff to review Virginia’s surface transportation infrastructure and funding.

ABOUT

Multiple state, regional, local, and private entities are responsible for different parts of Virginia’s multimodal surface transportation system. These entities plan for, operate, maintain, and improve system infrastructure and assets. Key parts of the system include roadways, public transit, passenger and freight rail, and bicycle and pedestrian networks. For FY22, the state plans to spend or allocate over $8 billion for surface transportation.

WHAT WE FOUND

Recent legislative changes increased revenues to address near- and long-term funding concerns

To address projected near- and long-term revenue constraints, the 2020 General Assembly substantially increased Virginia’s transportation revenues. From FY19 to FY21, annual state revenues increased by $578 million (16 percent). Revenues increased through a combination of tax rate increases, new revenue sources, and general growth in retail and motor vehicle sales. The 2020 changes further diversified the state transportation revenue base—which receives dedicated revenue from motor fuel taxes, retail sales taxes, vehicle sales taxes, and a variety of fees—and indexed state fuel taxes to inflation. The legislature also added regional taxes, increasing revenues from regions by about $300 million. These changes followed legislation passed by the 2019 General Assembly, which raised truck fees and diesel taxes. Under the new structure, commercial trucks, which have a greater impact on roadways, pay substantially more into the system than passenger vehicles.

Revenue increases will help to strengthen the state transportation system by providing more funding to improve the condition of existing roads and bridges, and to make system improvements to address congestion, safety, and economic development needs.

The restructured revenue stream makes it less likely the state will experience revenue shortfalls as motor fuel consumption declines over time. Because fuel taxes were increased and indexed to inflation, and fuel consumption is projected to decline gradually, it could be more than 10 years before the state experiences any significant decline in fuel tax revenues.

In 2020, Virginia created a highway user fee for drivers of fuel-efficient, hybrid, and electric vehicles. The state is also establishing a voluntary mileage-based user fee program so owners of fuel-efficient and electric vehicles can choose to be taxed based on how much they drive. These new user fees could eventually replace the fuel tax as a main source of transportation revenue. However, the long-term success of the mileage-based user fee program depends on how well it gains public acceptance. One key challenge is determining how to best protect participant privacy and limit the use of data collected under the program.

State infrastructure condition has been improving, but bridges are aging and locally maintained roads need further improvement

Virginia’s transportation infrastructure is in better condition than most other states. Virginia ranks 13th among states for pavement condition and 17th for bridge condition. Funding increases over the last decade and policy changes have resulted in substantial improvements in pavement condition and the condition of other assets, such as bridges.

Fewer of the state’s bridges are rated as “structurally deficient” than in the past, but because bridges are aging, more than one-quarter of the bridges are very close (i.e., one rating point away on the 10-point scale) to being rated structurally deficient. Structurally deficient bridges typically need to be fully replaced, while bridges in slightly better condition can often be rehabilitated at a much lower cost. Current law, though, prohibits State of Good Repair funds from being used for preventative bridge repair or reconstruction projects and caps the amount of funding that can be allocated to districts with the highest need.

Roads maintained by localities are in poorer condition than state-maintained roads. About two-thirds of locally maintained primary pavements are in sufficient condition, compared with 83 percent of those maintained by the Virginia Department of Transportation (VDOT). Localities with primary roads in the worst condition are generally those that are more fiscally stressed. Localities in the Richmond district had primary roads in the worst condition, with only 56 percent of lane miles in sufficient condition. Similarly, bridges maintained by localities are in slightly worse condition than bridges maintained by VDOT. The difference in condition suggests that the state’s maintenance payments to some localities may not be sufficient to keep pace with their road maintenance needs.

Transportation needs are identified through a data-driven process that engages key stakeholders, but a few regional corridors in rural areas may not be adequately included

Virginia uses an effective process to identify needed improvements to the transportation system. The state’s primary needs identification process, VTrans, uses a data-driven process to identify where the transportation system needs to be improved. VTrans also proactively engages local and regional stakeholders and uses their input to modify and refine needs.

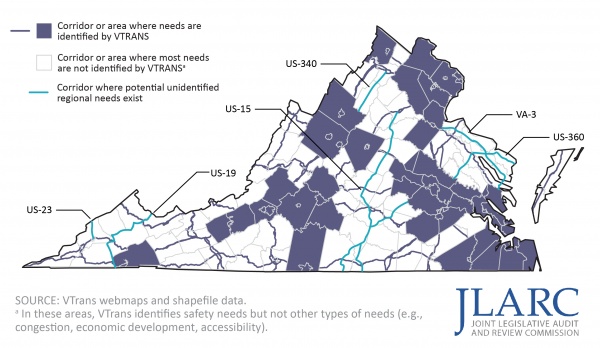

Though the needs identification process is effective, it could be more comprehensive because VTrans currently could be excluding some transportation needs of regional significance in rural areas. The Commonwealth Transportation Board (CTB) has already taken some steps to address this by expanding the VTrans scope to examine safety needs and needs related to economic development sites, but a few gaps remain. JLARC identified several potential corridors of regional significance in rural areas that are not included in VTrans needs assessments for congestion or travel time reliability (see figure). These routes often carry as much or more traffic than nearby corridors of statewide significance. Given the relatively high volume of traffic, and their importance to the localities they serve, any unidentified needs along these routes could be regionally significant and would merit evaluation under VTrans.

VTrans does not evaluate some potential transportation needs on a few corridors of regional significance

Virginia’s main program for funding system improvements (Smart Scale) is appropriately based on objective benefit and cost data

The state’s primary process to select projects to address transportation needs, Smart Scale, is an objective way to select transportation construction and other improvement projects. Smart Scale uses data to calculate the expected benefits relative to the state’s cost to fund different projects. Projects are scored relative to each other, and projects with the highest scores are recommended for funding. Smart Scale scoring is generally viewed as being objective and transparent, and the approach is consistent with a 2010 JLARC recommendation. Transportation experts indicated that Virginia’s Smart Scale project prioritization process is considered a model among states.

Despite local concerns, analysis of Smart Scale decisions over time concluded that selection decisions are generally equitable across regions and types of projects. The program has appropriately allocated funding across regions based on population, for example. The Office of Intermodal Planning and Investment (OIPI) has also analyzed Smart Scale decisions after each round of funding and refined the process to improve it over time. For example, OIPI changed Smart Scale safety scores to remove accidents attributable to driving under the influence because those accidents were not likely due to unsafe infrastructure.

Longer wait period for revenue sharing program grants, implemented in response to the pandemic, will no longer be necessary if revenue forecast improves as expected

In 2020, as part of a larger emergency response to the pandemic, the CTB took several actions to address revenue shortfalls in the state’s transportation budget. Some of these actions affected the revenue sharing program, which provides smaller-scale grants to localities for transportation projects. No new grants were issued under the program for FY21–24, and the window between when grant applications are submitted and funds are received was extended from one-to-two years to five-to-six years. These actions, along with others authorized by the General Assembly and taken by the CTB, seem reasonable and necessary in hindsight to keep Virginia’s transportation agencies functioning, continue maintenance activities, and avoid disrupting ongoing improvement projects.

Now that the temporary reduction in revenues due to the pandemic appears to have passed, the extended five-to-six year window between grant application and award no longer appears necessary. Delaying funding is contrary to the CTB’s established policy for the revenue sharing program and can increase project costs because material and labor expenses increase over time. Additionally, the General Assembly could restore some or all funding for new projects in the FY23–24 grant cycle, if there is an FY22 revenue surplus or if new projections show FY23–24 revenues could be higher than previously predicted.

Virginia transit assets are generally in serviceable condition, but systems face potential capital and operating funding shortfalls

Most of Virginia’s transit assets are in serviceable condition. More than 90 percent of facilities and fleet vehicles are in a state of good repair, as are 70 percent of non-fleet vehicles. All major rail asset types (vehicles, track, and facilities) in Virginia are, on average, in better condition than transit agencies nationally.

Transit agencies may face challenges in continuing to maintain these assets and improve their systems because state capital assistance is projected to lag behind needs. (This excludes Metro, which is funded separately from other transit agencies and appears to be receiving funds needed to carry out its capital improvement plan.) The Department of Rail and Public Transportation currently projects a $226 million gap in state capital assistance to transit agencies over the next five years, even though the state substantially increased transit capital funding in 2020. This gap could be substantially reduced if state transportation revenues continue to recover strongly from the pandemic and exceed the most recent revenue projections and if the federal transportation reauthorization and infrastructure bill is enacted.

Most of the state’s transit agencies, including Metro, are also facing uncertainty in future operating revenues because of the pandemic. Agencies saw substantial reductions in ridership, and as a whole, experienced fare losses of 57 percent. Agencies are using federal pandemic relief funds to cover gaps in their operating budgets, but many will have used these funds up within one to two years. Agencies may need to cut services unless ridership recovers or they receive additional state or federal funds.

WHAT WE RECOMMEND

Legislative action

- Amend the Code of Virginia to clarify and ensure data privacy for citizens choosing to participate in the mileage-based user fee program.

- Amend the Code of Virginia to reduce long-term costs and further improve bridge safety by allowing the State of Good Repair program to fund repair and reconstruction projects for bridges very close to being structurally deficient and by raising or eliminating the restriction on the amount of program funding a region can receive.

Executive action

- Update CTB policy to include corridors of regional significance in the VTrans needs identification process.

- Change the revenue sharing program policy implemented during pandemic to make grant awards available in the second biennium after grant applications are submitted (three-to-four years after application).

- Use the Commonwealth Transportation Board’s authority to distribute a portion of the FY21 transportation revenue surplus to the transit capital funding program.

Policy options for consideration

- Make minor changes to new highway user fee, to improve consistency and avoid future revenue gaps, by creating a regional surcharge and by applying user fees to electric vehicles weighing over 10,000 pounds

- Amend the Code of Virginia to change how road maintenance payments are distributed to cities and towns to better align payments with maintenance needs.

- Appropriate additional funds to the revenue sharing program for FY23–24, contingent on a surplus or projected increase in transportation revenues.

The complete list of recommendations and options is available here.