Operations and Performance of SBSD

WHY WE DID THIS STUDY

In 2018, JLARC approved a study resolution directing JLARC staff to review the operations and performance of the Virginia Department of Small Business and Supplier Diversity (SBSD).

ABOUT

SBSD was created in 2014 to promote the growth and development of small, minority-owned, and women-owned businesses (SWaM). SBSD facilitates the state’s SWaM initiatives, which include certifying businesses, and collecting annual SWaM plans and spending data from agencies to monitor their expenditures with SWaM businesses. SBSD also provides loans and other financing through the Virginia Small Business Financing Authority and offers business assistance programs.

WHAT WE FOUND

SBSD has addressed many of its administrative and staffing problems

SBSD has made substantial improvements since it was created in 2014 (by combining two separate agencies and adding the Virginia Small Business Financing Authority). Creating a new organizational structure and new processes takes time, and SBSD has made good progress. Over the last few years, SBSD has addressed financial problems identified in previous audits by the Auditor of Public Accounts and worked to improve its information technology systems. SBSD has also filled vacant staff positions, and its staff turnover is now similar to other state agencies. Staff in most divisions reported to JLARC they are satisfied with key aspects of their job and SBSD’s leadership and organizational culture.

SBSD is certifying businesses faster, but processes can still be improved

Processing times have improved for all types of SBSD certifications, in part because of its new online application system. For example, small business certifications were processed 49 percent faster in 2019 than in 2017. All small, micro, women-owned, or minority-owned certifications were processed faster than the 60-day goal, a substantial improvement from 2017.

However, businesses could benefit from having more information about the application and appeals processes. SBSD made almost 17,000 follow-up requests for 10,000 applications in 2019. Follow-up requests are often necessary because some businesses are unclear about the information they need to submit and the reasons for submitting it. In addition, many businesses are confused about the reasons why they can appeal if SBSD has denied their application.

SBSD’s certification processes are generally fair and have led to mostly accurate determinations, but the appeals process is unnecessarily limited. The appeals process is available only to businesses seeking recertification. Businesses seeking a new certification for the first time cannot appeal SBSD’s decision. This limitation appears to lack any policy basis and was put in place to limit the SWaM certification division’s workload.

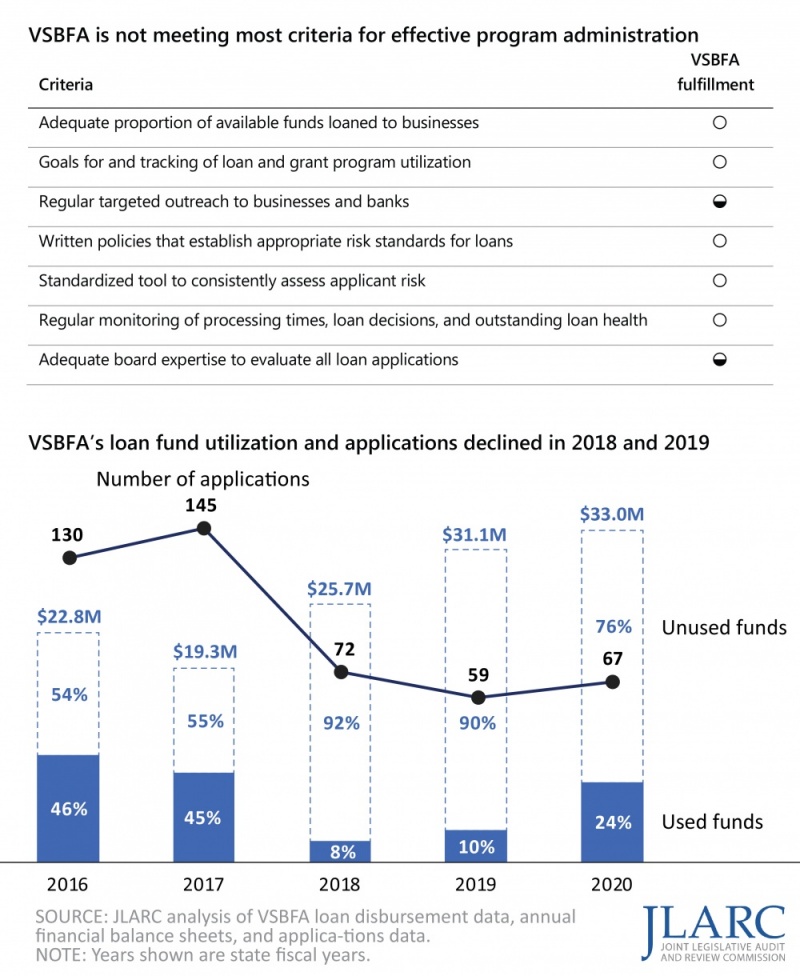

VSBFA’s shortcomings prevent it from fully achieving its mission

VSBFA can play a key role in helping small businesses obtain financing, which is now critical given the COVID-19 pandemic’s impact on small business sales and operations. However, VSBFA has not been meeting most key criteria for effectiveness. For example, VSBFA is not loaning an adequate proportion of available funds to businesses. In the last three years, the vast majority (92 percent to 76 percent) of available loan funds were not used across VSBFA’s six loan programs (figure). Loan applications also declined, dropping by half from 2017 to 2018 and continuing to decrease in 2019. VSBFA’s fund utilization and loan applications have increased slightly in 2020.

VSBFA also lacks written policies on risk standards for loans and a standardized tool for staff to assess applicants’ repayment risk. Without policies and a tool to govern loan decisions, VSBFA has tended toward caution and generally been too conservative when making loan decisions. This is inconsistent with the authority’s mission to provide gap financing to businesses who may not be eligible for private bank loans. VSBFA’s loan default rate is much closer to private banks than federal financing programs. Four of five banks interviewed described VSBFA as too risk averse. One bank noted that “after several unsuccessful attempts to partner, I just gave up on having the VSBFA as an option.”

The lack of consistent leadership likely contributed to VSBFA’s operational shortcomings, but a new director is now in place. VSBFA had five permanent or acting executive directors in three years. Several staff emphasized the adverse impact of inconsistent leadership, with one noting “this revolving door of leadership has caused the team to continually reset priorities.” VSBFA’s current executive director was hired in October 2019. He has a lending background and is viewed positively by staff and the board.

Procurement spending with SWaM businesses is substantial, but approach to SWaM goal and planning has limitations

Though the executive branch has not reached its goal to award at least 42 percent of discretionary procurement spending to SWaM-certified businesses, agencies procure a substantial amount of goods and services from SWaM-certified businesses. Agencies purchased more than $2 billion in goods and services from certified SWaM businesses in FY19, making up about one-third of applicable state procurement spending.

However, the 42 percent goal for procurement spending through SWaM businesses is not realistic or achievable for many agencies. In FY19, agency spending through SWaM businesses ranged from 4 percent to 87 percent. Sixty percent of agencies fell short of the 42 percent goal. More than half of agencies responding to a JLARC survey found it extremely, very, or difficult to achieve the 42 percent goal. This is primarily because agencies’ abilities to make purchases from SWaM-certified businesses vary substantially depending on the types of goods and services they need.

Furthermore, the SWaM plans agencies are required to develop are of limited value for many agencies. Less than half of agencies agreed that their SWaM plans helped maintain or increase their SWaM expenditures. The plans include some useful information but do not define specific strategies for agencies to increase spending with SWaM businesses. Historically, SBSD has given agencies little to no feedback on their SWaM plans.

Some certified businesses are much larger than most others, and business size varies substantially by industry

Most certified businesses in Virginia are much smaller than the state’s current definition of small business (a maximum of 250 employees or $10 million in average gross receipts). As of April 2020, the median certified small business employed 14 people and reported about $3.2 million in annual gross receipts—both well below the maximum allowable thresholds to be classified as a small business. Virginia’s small business definition is important because the state’s set-aside program requires agencies to use a micro business (a maximum of 25 employees and $3 million in gross receipts) for purchases up to $10,000 and a small business for most purchases up to $100,000, unless there are no micro or small certified businesses that meet the purchase requirements.

Some certified businesses in Virginia are substantially larger than most. For example, the top 5 percent of certified small businesses by size reported more than $25 million in average gross receipts (which is currently allowable because a business must only be at or below either the employee or gross receipt maximum thresholds.) In contrast to Virginia, some states require a business to be at or below both employment and gross receipt thresholds.

There are also considerable differences across industries that limit the usefulness of a single definition of a “small” business. One of the largest businesses in a given industry might be among the smallest in another industry. Virginia’s small business definition applies the same to all businesses regardless of industry. In contrast, the federal government and several states use size definitions that vary by industry.

Virginia could consider changing its small business definition to narrow the size definition generally, or develop specific size definitions by industry. These options would have varying impacts on currently certified businesses, SBSD’s administrative operations, and agencies’ ability to procure goods and services through small businesses. When considering any changes, it may be prudent for the state to consider the results of a pending study of whether there are disparities in procurement opportunities for minority- and women-owned businesses. If evidence of disparities is found, the state could consider adjusting its preferences for the state’s set-aside procurement program to include female or minority ownership.

WHAT WE RECOMMEND

Executive action

- Provide businesses with more information about the SWaM certification application and appeals processes

- Allow SWaM businesses who have been denied a new certification to appeal SBSD’s decision

- Set annual utilization goals for small business loan programs that consider factors such as credit conditions and available loan funding, and track and report how much of available funding is being used

- Develop formal loan risk policies and implement a standardized risk assessment tool to govern loan application decisions

- Require VSBFA staff to develop an improvement plan and provide periodic progress reports to the board

- Institute a more meaningful SWaM plan development and review process that focuses on agencies’ strategies to improve SWaM spending

Policy options for consideration

- Develop agency-specific SWaM spending goals that are ambitious, but more realistically achievable based on each agency’s procurement needs

- Amend the Code of Virginia to narrow the definition of small business to exclude larger businesses currently eligible for certification

- Amend the Code of Virginia to define small business based on industry or industry groupings

- Authorize an executive branch workgroup to consider whether and how to adjust the state’s procurement preferences and small business definition using the results of the 2020 disparity study and JLARC study

The complete list of recommendations and options is available here.