Eligibility Determination in Virginia’s Medicaid Program

WHY WE DID THIS STUDY

The General Assembly directed JLARC to review the eligibility determination process for Medicaid benefits in Virginia. Medicaid eligibility determination in Virginia is undergoing significant changes, including new policies for most Medicaid applicants and a new information system used for all applicants. In the midst of these changes, eligibility determinations need to remain accurate and timely to ensure that only eligible applicants receive benefits.

ABOUT VIRGINIA'S MEDICAID PROGRAM

The Virginia Medicaid program provides medical, long-term care, and behavioral health services to more than one million individuals each year. The Department of Medical Assistance Services (DMAS), which administers the program, paid almost $8 billion in state and federal funds for services in FY 2014.

DMAS and the federal government set Medicaid policy. The Virginia Department of Social Services oversees the implementation of eligibility policy, and local departments of social services (local DSS) carry out policy to determine the eligibility of individuals.

WHAT WE FOUND

Virginia policies do not ensure that all eligibility criteria are verified for all individuals

State policy does not require eligibility workers to search for either unreported income or unreported assets. Without complete information, Virginia is vulnerable to erroneously providing benefits to individuals who do not meet financial eligibility criteria for the Medicaid program. Virginia’s policies were developed when information was verified manually and identifying unreported resources would have been difficult, but the state is increasingly able to verify eligibility criteria using electronic data sources.

A 2012 triennial federal review showed that Virginia’s eligibility error rate had significantly improved since the previous review in 2009. Recent pilot reviews indicate a modest increase in errors, which may be curbed once the eligibility determination process reaches a steady state.

Late eligibility determinations may delay access to health care and result in spending on ineligible recipients

Local departments of social services (DSS) have struggled to determine eligibility for many Medicaid applications within prescribed time standards, which can delay access to health care for eligible applicants such as pregnant women. The number of overdue applications has decreased substantially in recent months, but it remains relatively high: one quarter of Medicaid applications submitted during the first quarter of 2015 were approved late.

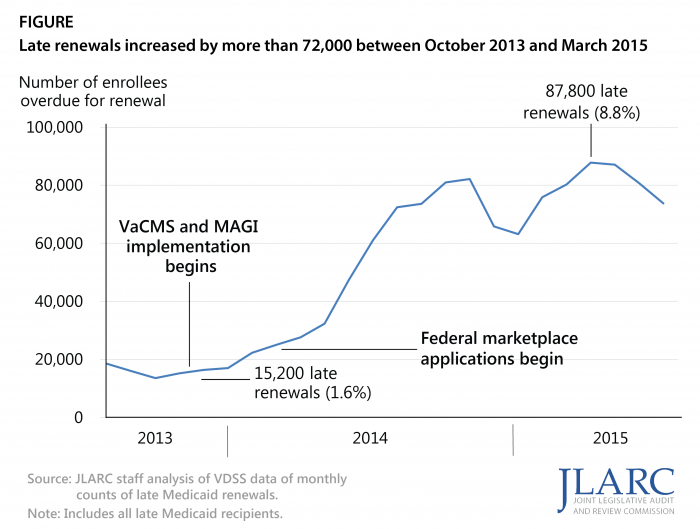

Local offices have also been unable to renew the eligibility of some Medicaid recipients every 12 months as required, due to considerable changes to the eligibility determination process and a significantly increased workload. When renewals are performed late, Medicaid recipients who have become ineligible continue to receive benefits. In FY 2014, it is estimated that between $21 million and $38 million was spent on benefits for ineligible recipients whose renewals were processed late. Half of these benefits were paid with state funds.

Half of all overdue renewals in Virginia in FY 2015 were concentrated in only six local offices. Five of these six offices also have some of the lowest staffing levels relative to caseload in the state, partly because the current method of allocating base administrative funds to local DSS offices is outdated and does not reflect current workload.

Virginia does not proactively identify assets that could be recovered to offset Medicaid expenses

Virginia does not proactively identify assets that could be recovered from the estates of deceased Medicaid recipients to reimburse the cost of the services they received. The state currently relies primarily on heirs and estate administrators to disclose or self-report the existence and value of assets, creating a conflict of interest because these individuals may stand to inherit the assets if they are not used to reimburse the state for Medicaid expenses. Virginia recovered just $883,000 from 207 estates in FY 2014. Identifying assets for recovery was difficult before the availability of electronic data. The state’s new eligibility determination system will soon contain information that could be used to identify which estates may have recoverable assets and prioritize those with the highest values.

WHAT WE RECOMMEND

Legislative action

- Direct DMAS to change Medicaid eligibility policy to require (i) checking electronic data sources when applicants report zero income and (ii) searching for unreported assets when applicants are subject to an asset limit.

- Direct VDSS to review and revise the current allocation methodology for state administrative funds for local departments of social services.

- Direct DMAS to proactively seek recovery from the estates of deceased Medicaid recipients.

Executive action

- DMAS should develop a proposal to the General Assembly for using the central processing unit to address the backlog of overdue renewals.

The complete list of recommendations is available here.