Options to Make Virginia's Individual Income Tax More Progressive

"Excellence in Research Methods Award" - National Legislative Program Evaluation Society

WHY WE DID THIS STUDY

House Joint Resolution 567 (2021) directs the Joint Legislative Audit and Review Commission (JLARC) to study increasing the progressivity of Virginia's individual income tax system.

ABOUT TAX PROGRESSIVITY AND VIRGINIA'S INDIVIDUAL INCOME TAX

A progressive tax is one in which the share of income paid in taxes rises along with income. Under a progressive tax, higher income filers pay a higher percentage of their income in taxes than lower income filers. Virginia’s individual income tax consists of four in-come brackets, with gradually higher rates assessed in each bracket. In recent years, more than four million individual income tax returns have been filed annually in Virginia. Revenue from the individual income tax is by far the largest source of state general fund revenue.

WHAT WE FOUND

Recent changes to individual income tax will make it far more progressive

During the 2022 legislative session, Virginia made two changes to the individual income tax that will make it much more progressive. The standard deduction was nearly doubled, and the state earned income tax credit will now be partially refundable. Making earned income tax credits refundable—so that low income filers can receive a refund even if they have little or no tax liability—is what many experts say is the single most important element in establishing a progressive tax. Taken together, these changes will make Virginia’s income tax 45% more progressive than in 2021 (as measured by change in the “Suits” progressivity index, which measures the progressivity of taxes on all income groups), and more progressive than most other states’ income tax.

The more progressive individual income tax will reduce taxes for many filers, but especially low and lower-middle income filers. Low income filers (1st quintile of filers, up to $14,000 in income) will see their effective tax rate (percentage of income paid in taxes) decline substantially from 0.8% to -1.2%. Lower-middle income filers (2nd quintile of filers, $14,000 to $36,000 in income) will see their effective tax rates reduced by half, from 2.4% to 1.2%.

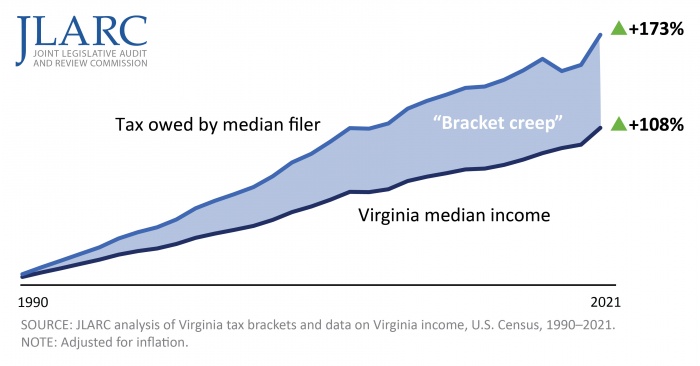

State could increase progressivity by reducing taxes on lower-middle and middle income filers

The General Assembly could also increase the individual income tax’s progressivity for lower-middle and middle income (3rd quintile, $36,000 to $68,000 in income) filers by updating the tax brackets to account for inflation. Virginia’s income tax has become less progressive over time, because the income tax brackets have remained the same since 1990. During this time, Virginia median income rose 108%, but income taxes owed by a single filer with median income increased 173%. This difference is due to a much higher percentage of each filer’s income being taxed at Virginia’s highest rate of 5.75% on income of more than $17,000. Tax experts refer to this dynamic as “bracket creep.” Incomes rise over time, but income tax brackets do not.

Taxes owed have far outpaced median income, because income brackets have not been changed since 1990

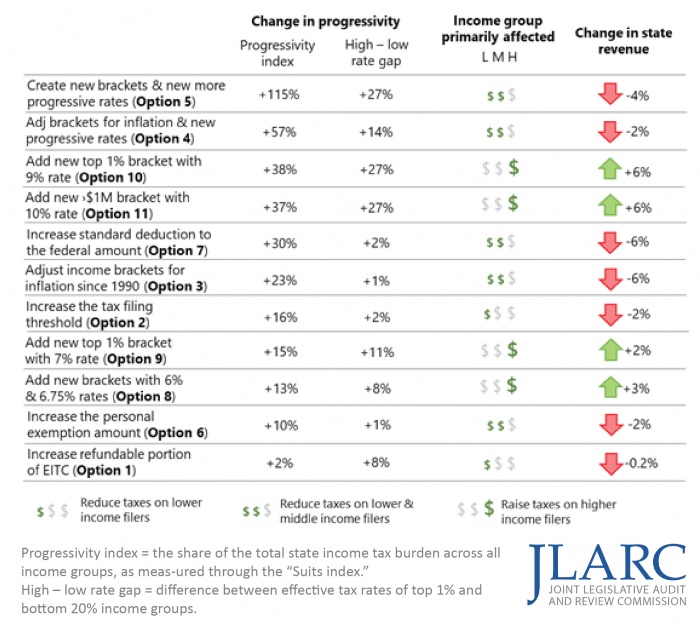

The state could alleviate this bracket creep by adjusting the income brackets by the cumulative rate of inflation since 1990. Doing so would increase progressivity by 23% (See Figure, Option 3). Because this would address 32 years of inflation, this option is estimated to result in a substantial one-time, 6% reduction in revenue.

The state could increase progressivity even further by adjusting the income brackets based on inflation since 1990 and creating a new and more progressive rate structure. The more progressive structure would feature a lower rate for low income filers (1% vs. 2%) and a higher rate for high income filers (6.5% vs. 5.75%). This option would increase progressivity substantially and do so in a cost-efficient manner, because revenue would only decline about 2% (See Figure, Option 4).

The state could also develop completely new income brackets and rates, specifically designed to result in a very progressive income tax by adding brackets and increasing the span between the highest and lowest tax rates. This option would be by far the largest increase in progressivity of all 11 options identified by JLARC. Though this option would increase progressivity the most, it is estimated to reduce revenue by about 4% (See Figure, Option 5).

State could increase progressivity through higher tax rates for higher income filers

The core reasons cited for income tax progressivity are the (i) substantial and growing income differences between high and low income households and (ii) high income households’ much greater ability to pay taxes. The state could, therefore, consider raising taxes on higher income filers to increase the progressivity of the state’s income tax. Some other states with more progressive taxes, such as California, levy much higher rates on high income filers than Virginia.

The state could create a new income bracket for the top 1% of filers by income (about $600,000 or more in income) and apply a 9% tax rate. This option would increase progressivity by 38% (See Figure, Option 10). Alternatively, the state could create a new income bracket with a 10% rate that would apply only to approximately 17,000 filers with more than $1 million in income. This option would increase progressivity by 37% (See Figure, Option 11). Both of these options are estimated to raise an additional 6% in revenue.

These (and several other) options that raise additional revenue could be paired with options that would lower revenue to minimize or eliminate revenue impacts to the general fund.

Progressivity could be preserved over time through indexing brackets to inflation

The federal government and many states regularly adjust their income brackets, standard deductions, and personal exemptions to account for inflation and reduce bracket creep. The majority of states that tax wage income make regular (usually annual) adjustments for inflation. Virginia could maintain the progressivity of its income tax over time by updating its income brackets annually based on inflation.

JLARC identified 11 options to increase progressivity

The complete list of recommendations and options is available here.